Among solo attorneys and small firms in Solon, Cleveland, Akron, and throughout Ohio, a common misconception still lingers:

“If I don’t carry malpractice insurance, that’s my choice—and my risk.”

In Ohio, that belief is incomplete and potentially dangerous.

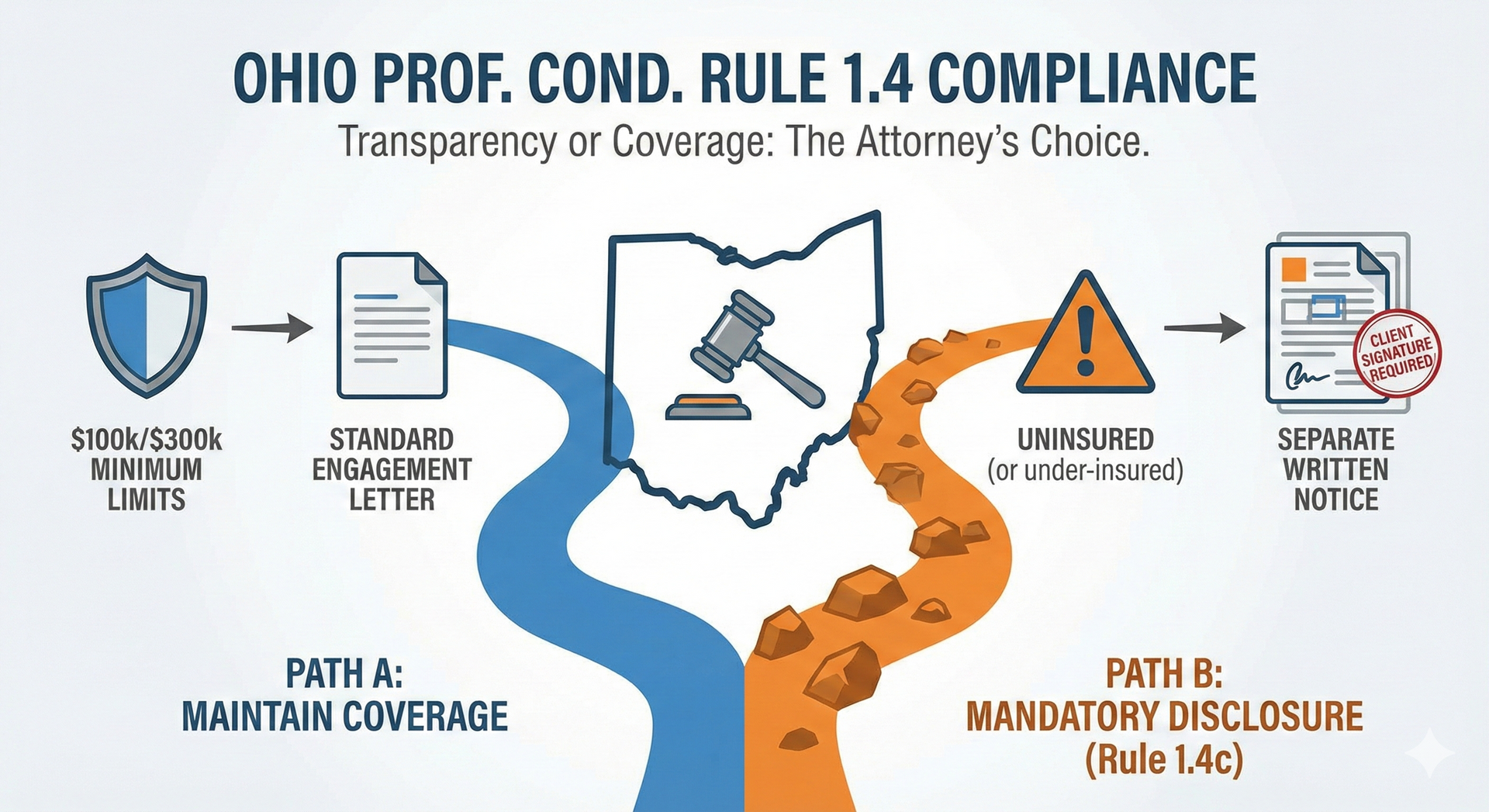

While the State of Ohio does not require attorneys to carry Lawyers Professional Liability (LPL) insurance to practice law, the Supreme Court of Ohio—through the Ohio Rules of Professional Conduct—has imposed a strict alternative. Since its adoption, Rule 1.4(c) has fundamentally changed the client intake process for any attorney who is uninsured or underinsured.

At Professional Liability Services Inc. (PLSI), we regularly speak with attorneys who only discover this rule after receiving a grievance inquiry or realizing their intake process is noncompliant. This article explains exactly what Rule 1.4(c) requires, the risks of ignoring it, and how many Ohio attorneys ultimately choose to solve the problem permanently.

Why Rule 1.4(c) Exists: Transparency and Client Protection

Historically, most clients assumed their attorney carried malpractice insurance. When a serious error occurred and the attorney lacked both insurance and collectible assets, clients were left without meaningful recourse—damaging public trust in the legal profession.

Rule 1.4 governs attorney communication. Subsection (c) was added to ensure clients can make a fully informed decision before hiring a lawyer, including understanding the financial consequences if something goes wrong.

At its core, Rule 1.4(c) is a consumer protection rule. It forces transparency at the very beginning of the attorney-client relationship.

The Three Non-Negotiable Requirements of Rule 1.4(c)

Compliance is not flexible or informal. Disciplinary authorities interpret this rule strictly. If you do not meet the insurance threshold, you must satisfy all three of the following requirements.

1. The Coverage Threshold: $100,000 / $300,000

The rule applies to any Ohio attorney engaged in private practice who does not maintain professional liability insurance with minimum limits of:

- $100,000 per claim (or occurrence)

- $300,000 aggregate for the policy period

Important nuance: Carrying a policy with limits below this threshold—such as an older or part-time “micro-policy”—is treated the same as having no insurance at all. Inadequate coverage still triggers the full disclosure requirement.

2. Timing: Disclosure Must Occur “At the Time of Engagement”

This is where many attorneys unintentionally violate the rule.

The disclosure must be provided at the time the client is engaged—not weeks later, not after work begins, and not with a first invoice.

In practice, this means the disclosure must be part of your intake process and presented alongside—or immediately before—the fee agreement. If you begin work based on a verbal agreement and delay written documentation, you may already be out of compliance.

If you were insured at the outset but later cancel, fail to renew, or lose coverage due to carrier insolvency, you must notify the client in writing within 30 days of the lapse.

3. A Separate, Standalone Client Signature

This is the most common compliance failure we see.

The disclosure cannot be buried inside a lengthy engagement letter or hidden in fine print. Rule 1.4(c) requires a separate document that the client signs acknowledging the lack of insurance.

The intent is clear: the client must pause, read, and affirmatively acknowledge the risk they are assuming.

Required Disclosure Language

The rule specifies the exact language that must be used. Attorneys are not permitted to soften or paraphrase it.

The disclosure must state:

“Pursuant to Prof. Cond. R. 1.4, I am hereby advising you that I do not maintain professional liability insurance of at least $100,000 per occurrence and $300,000 in the aggregate.”

The document must include the client’s signature and date and be retained in your records.

The Consequences of Ignoring the Rule

Some attorneys assume compliance issues will never surface because their clients “trust them.” That assumption carries serious risk.

Failure to provide the required disclosure is a direct violation of the Rules of Professional Conduct. Grievance committees treat these violations seriously because they involve nondisclosure of material information to clients. Sanctions can range from public reprimands to suspension, particularly if the failure is repeated.

If a malpractice claim arises and you failed to comply with Rule 1.4(c), the ethical violation becomes a powerful weapon for the plaintiff. Even before the merits of the case are addressed, your credibility is undermined.

There is no harmless-error exception. Even perfect legal work does not cure a disclosure violation.

Managing the Client Conversation

If you choose to practice without insurance, the disclosure conversation must be handled carefully.

The most effective approach is neutral and matter-of-fact. Present the disclosure as a mandatory Ohio requirement rather than a personal shortcoming.

That said, some clients—particularly business and corporate clients—will decline to proceed once they learn you are uninsured. For many organizations, hiring an uninsured professional violates internal policy.

The PLSI Perspective: Eliminating Disclosure Risk Entirely

While Ohio permits attorneys to practice without malpractice insurance, many attorneys ultimately decide the administrative burden, client friction, and disciplinary exposure outweigh the cost savings.

For solo attorneys and small firms in Solon, Cleveland, Akron, and throughout Ohio, the assumption that LPL insurance is unaffordable is often based on outdated or incomplete information.

Professional Liability Services Inc. focuses exclusively on legal malpractice insurance. With access to over 20 carriers, we regularly help Ohio attorneys secure compliant coverage that meets the $100,000 / $300,000 threshold—often at a cost far lower than expected.

Frequently Asked Questions

Is malpractice insurance required to practice law in Ohio?

No, but attorneys without adequate coverage must comply with the disclosure requirements of Rule 1.4(c).

Can the disclosure be included in my engagement letter?

No. The rule requires a separate document with a standalone client signature.

Does this apply to solo or part-time attorneys?

Yes. Any attorney engaged in private practice in Ohio is subject to the rule.

What happens if I forget to give the disclosure?

Failure to disclose is an independent ethics violation, regardless of whether any malpractice occurred.

If you’re unsure whether your current policy meets Ohio’s Rule 1.4(c) requirements—or you want to eliminate disclosure risk entirely—PLSI can review your coverage and tell you exactly where you stand.

One compliant policy can remove intake friction, protect your license, and give both you and your clients peace of mind. Contact Professional Liability Services Inc. to make sure your practice is fully protected.