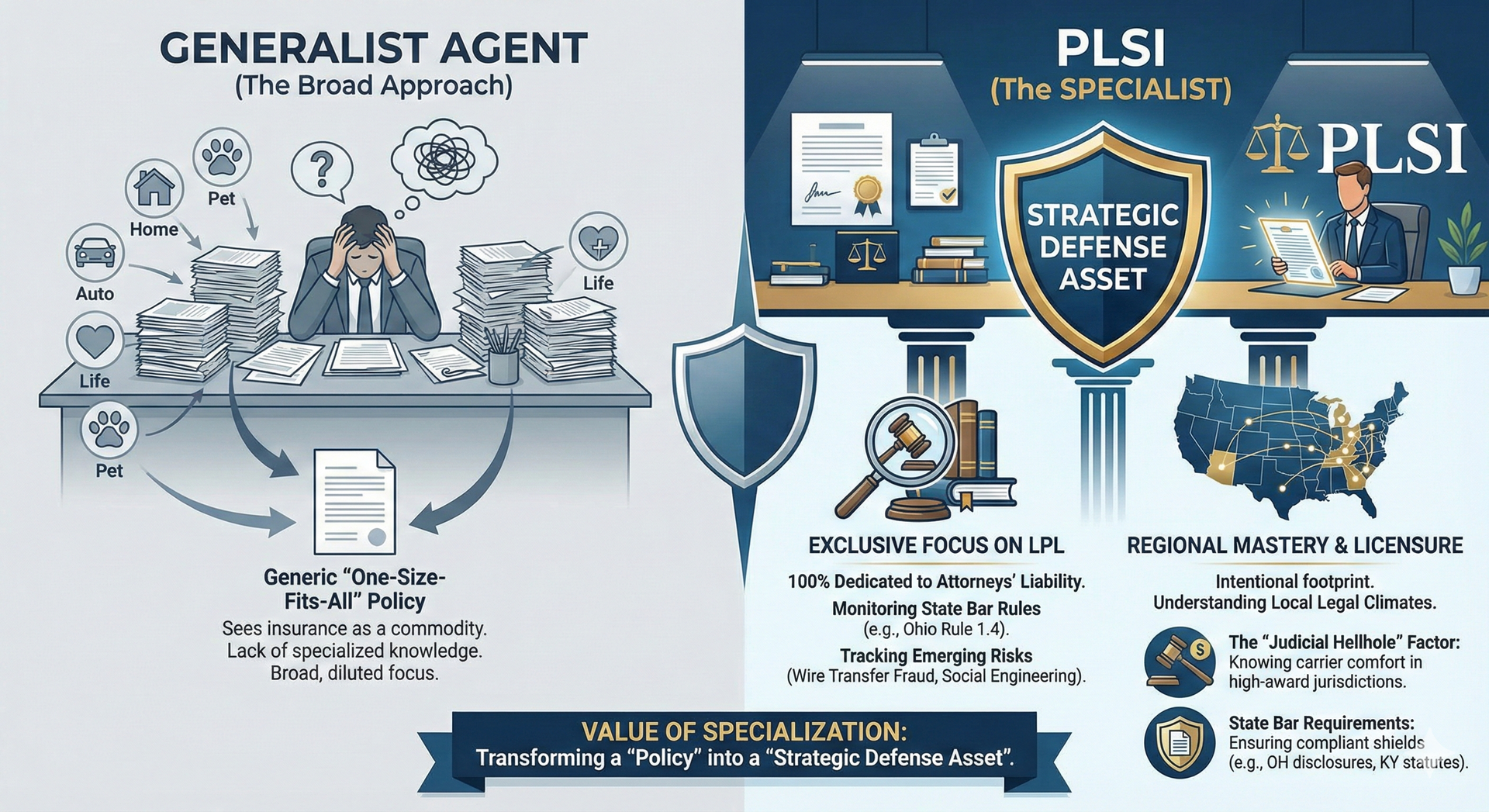

The Danger of the "Generalist" Trap

In the legal profession, specialization is the hallmark of excellence. You would rarely find a high-stakes litigator moonlighting as a patent prosecutor, nor would a seasoned estate planner suddenly decide to defend a multi-district class action without significant preparation. The law is too complex, the stakes are too high, and the nuances are too varied for a "jack-of-all-trades" approach.

Yet, when it comes to the very mechanism that protects a lawyer’s livelihood—Lawyers Professional Liability (LPL) Insurance—many firms rely on generalist insurance agents. These are often the same agents who handle their homeowner’s insurance, their fleet of delivery trucks, or their general office liability.

At Professional Liability Services Inc. (PLSI), based in Solon, Ohio, we believe this is a fundamental mistake. LPL insurance is not a commodity; it is a highly technical, "claims-made" legal instrument. In this comprehensive guide, we explore why working with a specialist in Ohio, Michigan, Indiana, Kentucky, South Carolina, Tennessee, Arizona, and Georgia is the only way to truly secure your firm's future.

The Anatomy of a Specialist: What Sets Us Apart

To understand the value of specialization, one must look at what a generalist agent misses. A generalist sees a "policy." A specialist sees a strategic defense asset.

1. Exclusive Focus on LPL

At PLSI, we don't sell life insurance. We don't sell auto insurance. We focus 100% of our energy on the professional liability needs of attorneys. This exclusivity allows us to stay abreast of the shifting landscape of legal malpractice. We monitor changes in state bar rules, such as Ohio’s Rule 1.4, and track how different carriers react to emerging risks like wire transfer fraud and social engineering.

2. Regional Mastery and Licensure

While we are rooted in the Solon/Cleveland area, our footprint across the Midwest, South, and Southwest is intentional. Each of the states where we are licensed—including Georgia, Arizona, and Michigan—has a different legal climate.

- The "Judicial Hellhole" Factor: Certain jurisdictions are known for higher jury awards. We know which carriers are comfortable in those environments and which ones will charge a "geographic surcharge" that you might be able to avoid with the right presentation.

- State Bar Requirements: From the mandatory disclosures in Ohio to the specific statutes of limitations in Kentucky, our regional expertise ensures your policy isn't just a piece of paper, but a compliant shield.

The "Claims-Made" Nuance: A Technical Deep Dive

Most insurance (like your car insurance) is "occurrence-based." If the accident happened while the policy was active, you're covered. LPL insurance is different. It is "claims-made and reported."

This is the area where generalist agents make the most catastrophic errors. If a specialist isn't managing your transition between carriers, you risk losing your Prior Acts Coverage.

- The Retroactive Date: This is the "birth certificate" of your coverage. If an agent moves you to a new carrier and fails to secure your original retroactive date, you effectively have zero coverage for any work performed in the past—even if you had insurance at the time.

- The Reporting Window: Many policies have strict requirements on when a potential claim must be reported. A specialist helps you navigate the "circumstance reporting" phase, ensuring that a disgruntled client's email doesn't turn into an uncovered claim later because it wasn't reported during the policy period.

The Power of 20+ Carriers

A common misconception is that all insurance agents have access to the same markets. In reality, the top-tier LPL carriers—the "A-Rated" giants—often prefer to work with specialized brokers like PLSI. They know that when we submit an application for a firm in South Carolina or Tennessee, the data will be accurate, the risk management protocols will be documented, and the firm will be properly "vetted."

Because we represent over 20 carriers, we create a competitive environment for your business.

- The Solo Advantage: We have carriers that specialize in low-cost, high-protection "First Dollar Defense" policies for solo practitioners.

- The Large Firm Solution: For firms with 15+ attorneys, we can layer coverage, utilizing "Excess" policies to reach the limits required by your largest corporate clients.

Risk Management: Beyond the Policy

A specialist’s job doesn't end when the policy is bound. At PLSI, we act as a risk management partner. We provide our clients with:

- Engagement Letter Templates: The #1 way to prevent a malpractice claim is a clear, written scope of work.

- Conflict of Interest Protocols: We help you refine your internal systems to catch "conflicts" before they become "claims."

- Cybersecurity Guidance: In 2026, a lawyer is a data custodian first and a counselor second. We ensure your LPL policy is integrated with (or includes) robust Cyber Liability protection.

Conclusion: Your Reputation is Your Most Valuable Asset

If you are a lawyer in Solon, Ohio, or practicing across our licensed states, your reputation is built on years of hard work, late nights, and ethical practice. Why leave the protection of that reputation to an agent who spends most of their day quoting home and auto bundles?

Specialization isn't just a buzzword; it’s a necessity in the modern legal landscape. At Professional Liability Services Inc., we speak your language, we understand your risks, and we know exactly how to defend the scale of justice when it's tipped against you.